Best otc bitcoin stocks - sorry, that

Opinion you: Best otc bitcoin stocks

| EXCHANGE FEATHERCOIN FOR BITCOIN | |

| BTC 3RD SEMESTER SCIENCE PAPER 2015 | |

| UP BTC PRIVATE COLLEGE LIST IN VARANASI | |

| BITCOINTALK DEUTSCH | |

| 3500 BTC |

Set up your own KYC/AML-compliant OTC Desk.

Give your customers access to deals instantly. Securely.

OTCTrade.com is a white-label solution for exchanges and trading desks. The platform connects buyers and sellers who wish to execute over the counter deals in a secure way.

What makes OTCTrade.com unique

Verified traders

Verify every trader, exchange, and trading desk that signs up on the platform and perform background checks (KYC, AML) to avoid scams.

Guaranteed transactions

Move funds in seconds with multi-party computation, a solution that enables the secure transfer of digital assets and guarantees transactions.

Instant Settlement

Faster settlement timing for both crypto to crypto and fiat to crypto deals. Funds will be swapped in the traders' accounts instantly.

Whitelabel OTCTrade.com's Platform Today.

And, connect with other whitelabelled OTCTrade desks to expand your deal network.

Save months and years of development time and costs. Instantly set up your own world-class trading desk and customize it with your own branding. This P2P solution is even ideal for existing exchanges because OTCTrade.com eliminates real and perceived conflicts of interest associated with non-transparency, intermediaries posing as counterparties. Buyers deal directly with sellers.

The problem: An Outdated Process

Vulnerability

Current exchange platforms (Whatsapp, Telegram, Skype, etc.) pose significant vulnerability risk. Hackers can infiltrate and hijack trades, resulting in the loss of millions of dollars.

No discovery

Lack of discovery tools for more legitimate and verified sources prevents small and medium-sized funds from being found and prevents growth, restricting the industry to remain stagnant as more significant players in the space receive all the traffic.

Transparency

The layer of anonymity that OTC trading provides prevents the collection of valuable data on OTC traders.

Distributed

There are too many platforms that exist and it can be challenging to keep track of all of them.

No end-to-end solution

No platform currently offers a complete solution.

Inefficient

Long, slow, lengthy, and inefficient trading process. Current platforms can take hours or even days.

The Solution

Quick Product Tour

01

Our software plugs seamlessly into your onboarding process, allowing full control of who can use your platform.

Every trader goes through a KYC process, designed to eliminate fraud. Your customers can link their custody wallets to the platform as proof to other traders that the posted assets are in their full control.

02

OTCTrade.com locks in asset prices for 30 seconds while the deal is completing negotiations. This gives traders time to reconsider, re-price, validate or cancel.

03

Traders get full control. Users verify and validate deal details before executing each trade. Security is enhanced with 2-Factor Authentication (2FA) to ensure safety.

Once the trader confirms execution, the trade is settled instantly. Blazingly fast.

04

Get up to date information on deal transactions at the click of a button. Locate the transaction ID, time stamp, transaction amount, fees, counterparty information, and more. Now you can easily audit your deals from one screen.

Industry Leading Features

Exclusive Access to the Best Deals

Access quality, exclusive deals securely, right in our platform.

Blazing Speed

Launch a desk that offers bespoke deals and transactions that settle instantly.

Each Portfolio Insured to USD 5 million

Get peace of mind from any loss due to theft, hacking, or malicious activity. Additional insurance is optionally available.

Auditable Transactions, Secure Trading Environment

Perform background checks and verify each trade and user. Every transaction is audited.

Strict Deal Confidentiality

Implement strict confidentiality for every offer, deal, and counter-offer within the platform. All transactions handled with a high degree of privacy.

Greater Liquidity with Institutional Grade Compliance

We partnered with PrimeTrust for compliance to ensure greater liquidity for our clients.

Our Trusted Partners

Companies that are helping us build the greatest over-the-counter platform of all time.

Latest From Our Blog

The first end-to-end platform in the OTC space

OTC Trade is on track to position itself as a vertical leader by creating the first end-to-end platform in the space. Our objective is to ensure global reach by targeting trading desks and brokers from across the world. The company is founded by a team that has a strong track record in crypto, investing, and information technology.

Implement our white-label solution

Feel free to use the form below, or contact us directly via hello@otctrade.com

Request sent successfully

Thank you for your request! We have received your request and will get back to you shortly.

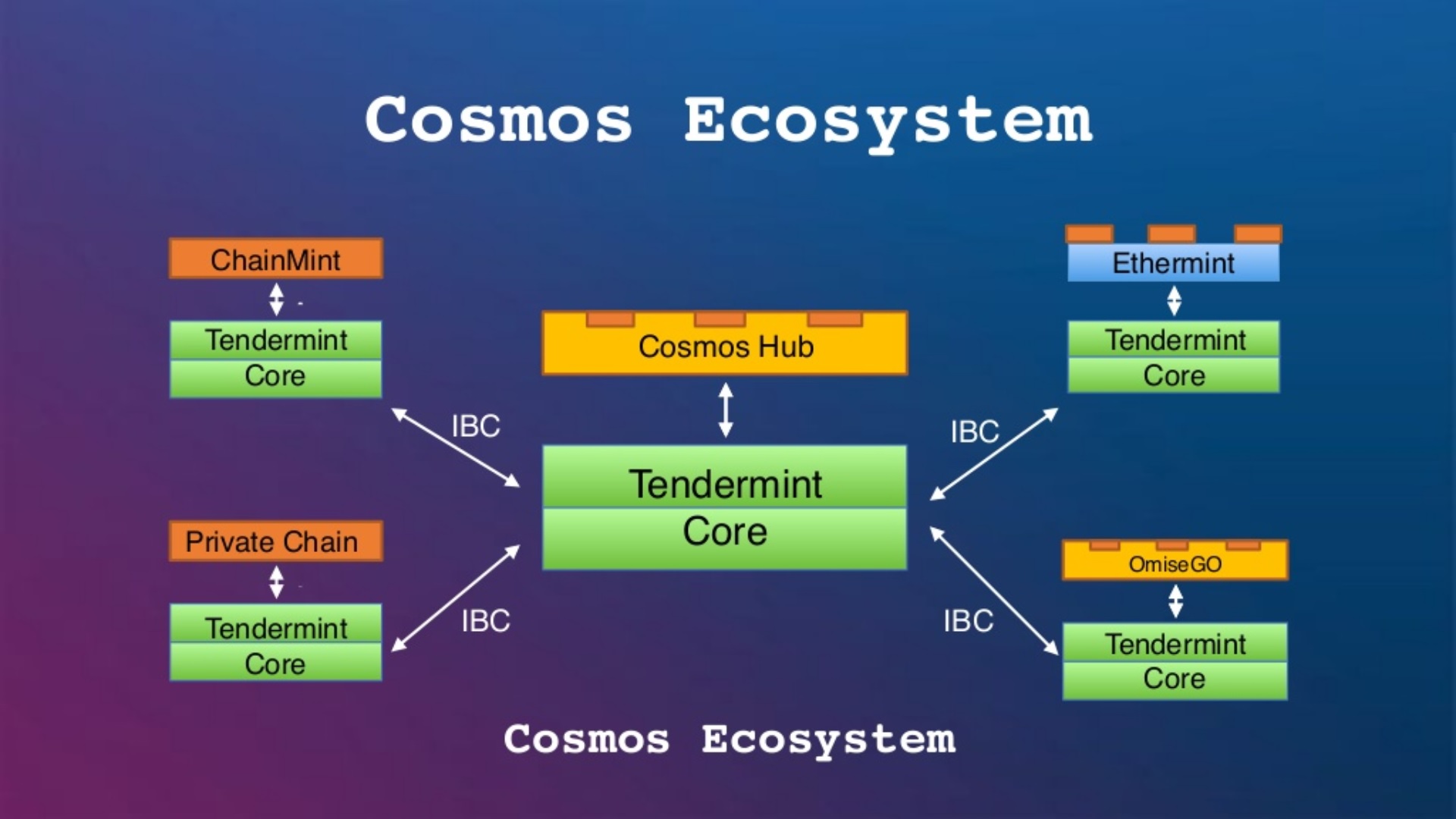

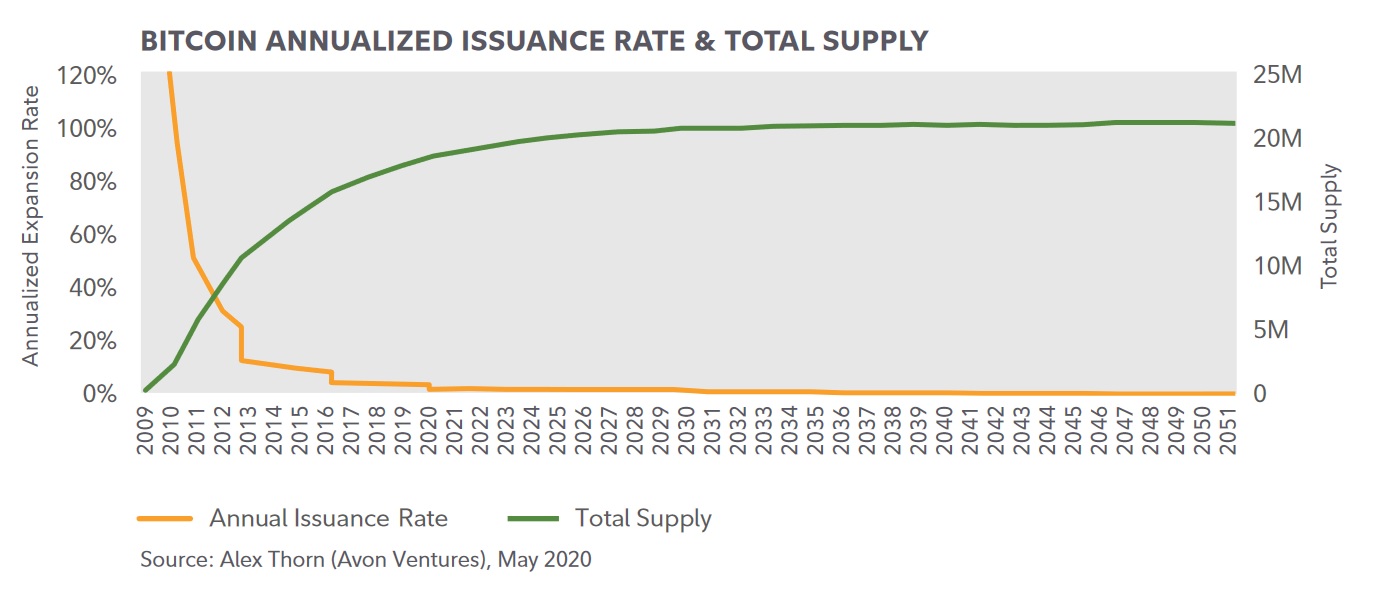

[{"title":"Impact of US Election on Cryptocurrency Market","image":"https://images.ctfassets.net/4x910isj0ns2/1Z7yhT3Btt6kdUcqEPjGJB/e5f44e873495c41213e91c6da662f3c4/flag-1291945_1920.jpg","description":"The US election has been one of the main events driving the stock market in the second half of 2020. But it has also indirectly influenced the cryptocurrency market because, no matter how different the crypto assets are from traditional finance, they tend to overlap here and there, especially given that institutional investors are involved. \n\nOn November 3, US citizens gave their votes and Democrat candidate Joe Biden secured the victory with 306 Electoral College votes, while incumbent President Donald Trump obtained 232 electoral votes.\n\nEven though Biden is a clean winner, investors didn’t expect such a narrow gap during the first days of counting. Trump doesn’t recognize the results to this day, though he green-lighted Biden’s transitioning to the White House.\n\n\n\nIn the first days after the election, Bitcoin surged along with the US stock market. It is not the first time when the cryptocurrency shows strong correlation to Wall Street indexes. Temporary analogue behaviors started with the emergence of the COVID-19 pandemic, which caused both equities and digital assets to tumble to multi-year lows. A similar pattern of moving in tandem could be observed after November 3, when both Bitcoin and US equities rallied.\n\nIn the first five trading sessions after Election Day, the benchmark S&P 500 index jumped more than 5%, which was by far the best performance during a similar period compared to previous elections. The momentum strengthened during the last days of the monitored period after Pfizer announced that its experimental COVID vaccine was more than 90% effective based on its late-stage trial. Here is how the 5-day post-election stock rally compares to previous similar periods [as per data](https://www.reuters.com/article/us-usa-election-stock-performance/how-the-u-s-stock-market-has-treated-new-presidents-idUKKBN27R2O1) from Refinitiv:\n\n\n\n## The Driving Factors Behind Stock Rally\n\nGiven the high correlation between Bitcoin and the stock indices, you might be interested in knowing why equities jumped after the election. In fact, stocks were boosted not just because of Biden’s win, but because his victory was not as emphatic as expected.\n\nMarkets surged because investors were satisfied with the political gridlock that was showing up as the vote counting was going on. Previously, economists anticipated a so-called “blue wave,” a scenario in which Democrats would have taken control of both the White House and the Congress. However, the results showed that Democrats’ dominance is less likely as they failed to secure a resounding win. Republicans will have a say in the Senate, which won’t allow Biden to implement some of the major projects that he planned, and that bodes well for corporate America.\n\nPreviously, Biden promised to increase corporate taxes and introduce new regulations to weaken monopolies. He targeted Big Tech in the first place. Now that a “blue wave” hasn’t materialized, equities surged, with Apple, Amazon, and Alphabet adding over 4% on the following day. Facebook jumped over 8% as investors welcomed the reduced antitrust risk amid a divided Congress.\n\nAnother major factor that pushed equities higher after the election was related to investors’ expectations of the next fiscal stimulus. The relief package had been under debate for weeks before Election Day, with Democrats backing a $2.4 trillion stimulus plan, while Trump’s Republicans aimed for a modest package of about $1.8 trillion. Now investors expect that the political gridlock resulting from the election would fuel the same uncertainty, which would cause the Federal Reserve to intervene and inject more cash, which would consequently lead to higher stock prices.\n\n## What Does It Mean for Bitcoin?\n\nBitcoin was already uptrending up until the election and the rally turned steeper after that. The fact that the Fed would likely maintain a loose monetary policy gave a boost to Bitcoin as well, which has been attracting investors betting against a devaluing US dollar.\n\nAlso, the general bullishness of equities on the back of a divided Congress simulated institutional investors with exposure to tech and other stocks, and that benefited Bitcoin as well. The cryptocurrency has experienced a spike in interest from institutions.\n\nAnother factor that pushed Bitcoin higher had to do with Trump’s refusal to admit the loss, citing fraudulent voting. The cryptocurrency has leveraged its safe-haven status amid these weeks of uncertainty.\n\nAll in all, it so happened that the optimism surrounding the COVID vaccines developed by Pfizer, Moderna, and AstraZeneca pushed equities higher, with the S&P updating the all-time high again and experiencing the best November on record so far. Elsewhere, Bitcoin almost touched its all-time high as well, though it retreated at the time of writing.\n\n\n\nThe cryptocurrency will continue to attract more investment particularly from institutions, which are hedging against the devaluing fiat currencies.\n\nFor example, Coinbase [said](https://news.bitcoin.com/coinbase-20-billion-cryptocurrency-custody-institutional-investors/) that it had seen “an explosion of incoming capital.” The largest crypto exchange in the US has about $20 billion worth of crypto under custody, $14 billion of which has been stored since April. The company confirmed a wave of institutional adoption.\n\nA recent report by Chainalysis [also suggested](https://blog.chainalysis.com/reports/bitcoin-price-surge-explained-2020) that institutional investors are the main drivers behind the current Bitcoin rally that propelled it above $19,000.\n\nThe pandemic will fade sooner or later, and the risk appetite will come back even stronger, with many institutions and retail investors counting on cryptocurrency for its ability to be independent and immutable. \n","author":"Anatol Antonovici","authorPhoto":"https://images.ctfassets.net/4x910isj0ns2/3KE1bbmwxCEWutch0Ep5tR/1cdfd5dfd21d54b4375a50153b30eec3/001.jpg","authorOverview":"Anatol is an experienced cryptocurrency journalist and analyst. He has worked for reputable crypto news outlets, including Cointelegraph, Bitconist, CryptoPotato, Cryptovest, u.today, and CCN, among others. Previously, he used to cover traditional markets, including stocks and foreign exchange, providing brokerage firms, asset managers, and other businesses with top-notch content. Anatol is easy-going and passionate about classical music.","date":"10 Dec 2020","metaTitle":"Impact of the Election on Cryptocurrency Market - Crypto News","metaDescription":"How will US politics change cryptocurrency? Here we explore the impact on the US election on the cryptocurrency market.","id":"7rrh9LBxI6JlTXDfqjx3BJ"},{"title":"5 Best Tokens to Stake in 2020","image":"https://images.ctfassets.net/4x910isj0ns2/5JPXlkXyZ3lnd9DLVBEIlZ/8efda266c1cd24ec7354187f36e8e05b/businessman-3300907_1920.jpg","description":"In a previous article, we [discussed](https://www.otctrade.com/blog/what-is-proof-of-stake-and-what-investors-should-know-about-it) the Proof of Stake (PoS) algorithm and introduced newcomers to staking, which is a passive income opportunity aimed at block validators in PoS blockchains. In the following lines, we’ll briefly describe ten tokens that are regarded as the best ones for staking. But before that, we’d like to share some insights from a survey carried out by our Chief Marketing Officer Al Leong, in collaboration with Shogo Ishida.\n\nAccording to the poll carried out earlier this year, more than half of respondents knew what staking is, and 76% of those who owned cryptocurrency knew. Thus, staking remains an underexplored territory, which can be regarded as an opportunity for those who want to make their first steps into this yield-generating activity.\n\nWe found it relevant that 40% of crypto owners would like to see their employers provide staking services for their clients. We at OTCTrade.com took into account the high demand for staking services and are planning to provide this option in the future as we roll out our OTC trading platform.\n\nThat being said, here are the five tokens that are the most popular for staking:\n\n## Cardano \n\nCardano is an open-source blockchain that is focused on providing financial applications to be used by individual consumers, businesses, and government. While it has similar features and capabilities to Ethereum, Cardano is promoting itself as a more advanced solution. It relies on a layered architecture that so far includes two layers: the settlement and the computational layer. The former enables the transfer of value through the native ADA tokens. The second layer is currently under development. It will allow users to initiate smart contracts. Also, the computational layer will enable developers and engineers to maintain and upgrade the network through soft forks.\n\nOn a side note, Cardano was co-developed by Ethereum co-founder Charles Hoskinson. He [said](https://twitter.com/IOHK_Charles/status/1289981387789832194) that the platform would start supporting smart contracts by the end of 2020. \n\nThe platform went live after a $60 million initial coin offering (ICO) and is backed by three nonprofits that are making the system run smoothly. They are the Cardano Foundation, IOHK, and Emurgo. \n\nCardano relies on a consensus mechanism called Ouroboros, which has been developed in-house based on a lot of research. It is a variation of PoS. \n\nThe annual yield for staking ADA ranges from 6 to 7%. \n\n| Cardano (ADA) |\n| ---------- | ---------- |\n| Price | $0.10 |\n| Estimated Annual Yield | 6-7% |\n| Total Supply | 45,000,000,000 (Circulating supply is 31,112,484,646) |\n|Staked tokens | 49% of circulating supply |\n| Consensus Algorithm | Ourobors |\n\n## Tezos\n\nTezos is a Swiss-based blockchain project that provides a multi-purpose digital ledger technology with smart contract capabilities. Tezos’ initial coin offering (ICO) held in 2017 was the largest at the time, with the project managing to raise $232 million. The blockchain network was designed by Arthur and Kathleen Breitman, who had previously worked for Morgan Stanley and Accenture. One of the unique aspects of Tezos is that it has a self-amending protocol based on its governance model, which allows it to change its own rules causing no disruptions to the network. The same model prevents Tezos from passing through hard forks.\n\nTezos uses a DPoS-like consensus mechanism similar to EOS, though it’s a bit different and is called Liquid Proof of Stake. It incentivizes network users who contribute to the development of Tezos.\n\nThe annual yield for staking the eponymous token with the ticker XTZ is between 5% and 7%.\n\n| Tezos (XTZ) |\n| ---------- | ---------- |\n| Price | $2.06 |\n| Estimated Annual Yield | 5-7% |\n| Total Supply | 850,675,019 |\n|Staked tokens | 79.15% |\n| Consensus Algorithm | Liquid Proof of Stake |\n\n## Cosmos (Atom)\n\nCosmos is one of the largest general-purpose blockchain networks that can be used by developers who seek to build decentralized applications (dApps). Nevertheless, the project offers more perks since it provides an ecosystem of parallel blockchains that have the ability to interoperate with each other within a distributed network. \n\nThe independent blockchains within Cosmos’ ecosystem are called ‘Zones’, and they are connected to a central blockchain called ‘Hub’. The Zones can interact between themselves via Hub using Inter Blockchain Communication (IBC). The consensus mechanism used on Cosmos is called Tendermint BFT, which is a PoS-like algorithm that merges more layers.\n\n\n\nhttps://www.slideshare.net/SunnyAggarwal2/tendermintcosmos-many-chains-many-tokens-one-ecosystem\n\nATOM, Cosmos’ native token, is currently the 24th largest cryptocurrency by market cap, as per Coinmarketcap data. The annual yield for staking ATOM ranges between 6% and 9%.\n\n| Cosmos (ATOM) |\n| ---------- | ---------- |\n| Price | $5.02 |\n| Estimated Annual Yield | 6-9% |\n| Total Supply | 261,270,948 |\n|Staked tokens | 63.81% |\n| Consensus Algorithm | Tendermint BFT |\n\n## Ontology\n\nOntology is another blockchain project that aims to improve scalability while maintaining a high degree of security and decentralization. It uses a unique consensus protocol called VBFT, which merges PoS, Byzantine Fault Tolerance (BFT) and Variable Room Functions (VRF). The algorithm enables a transaction speed of over 3,000 transactions per second.\n\nThe main selling point of Ontology is the easy integration into existing business infrastructures. The system enables companies with limited knowledge of blockchain to benefit from this innovative technology.\n\nThe Ontology platform hosts two coins – the Ontology coin called ONT and the Ontology Gas token with the ticker ONG. The latter acts as a compensation for those who contribute to the system, though users can stake ONT only.\n\nOntology is the closest partner of NEO, another Ethereum-like blockchain that relies on PoS and allows staking. It’s because both projects were developed by the same team known as Onchain.\n\nThe annual yield of staked ONT ranges between 3% and 5%.\n\n| Ontology (ONT) |\n| ---------- | ---------- |\n| Price | $0.46 |\n| Estimated Annual Yield | 3-5% |\n| Total Supply | 1,000,000,000 (Circulating supply is 751,872,993) |\n|Staked tokens | 25% of circulating supply |\n| Consensus Algorithm | Proof of Stake |\n\n## Qtum \n\nQtum (Quantum) is an Ethereum-like blockchain that runs on a PoS blockchain. It has Bitcoin-related elements, as it uses Bitcoin core code that relies on UTXO (Unspent Transaction Output) model, which is more difficult to explain in a few words but it adds to the security of the network. Besides this, Qtum supports smart contracts thanks to an abstraction layer called Account Abstraction Layer (AAL). This allows the Ethereum Virtual Machine (EVM) to reside on top of Qtum’s UTXO blockchain. Thus, Qtum combines elements from the two most trusted blockchains out there. Thanks to this, Qtum’s smart contracts are interoperable with both Bitcoin and Ethereum.\n\nQtum relies on a PoS-related consensus known as Mutualized Proof of Stake (MPoS). Those who want to become validators have to stake QTUM. In exchange for their effort, validators receive reward in the form of newly minted QTUM tokens plus the transaction fees.\n\nStaking QTUM can generate from 6% to 8% per year, which makes it one of the most preferred tokens among stakers.\n\n| Qtum (QTUM) |\n| ---------- | ---------- |\n| Price | $2.03 |\n| Estimated Annual Yield | 6-8% |\n| Total Supply | 102,788,316 |\n|Staked tokens | 16% of circulating supply |\n| Consensus Algorithm | Mutualized Proof of Stake (MPoS) |\n\nBesides the five tokens described above, here are other staking tokens with generous rewards:\n\n## Harmony\n\nHarmony is a blockchain for dapps that is promoted as a faster solution than other networks. The project has addressed the scalability issue by supporting state sharding, which splits the network into multiple parts that are handled simultaneously by independent groups of validators. Harmony’s consensus mechanism is called Effective Proof-of-Stake (EPoS).\n\nThose who choose to stake ONE, Harmony’s native token, should expect an annual yield from 5% to 11%.\n\n## Lisk\n\nLisk is a blockchain network that enables developers to create dapps based on Javascript, which is a widely used programming language. Thus, developers can create smart contracts using a more familiar language than Ethereum’s Solidity. Lisk allows users to create custom dapps via sidechains, which are private blockchains connected to Lisk’s mainnet.\n\nThe estimated annual yield for staking LSK is up to 2%.\n\n## IRISnet\n\nIRISnet is a blockchain project that was launched in 2019. It acts as a communication relayer for other blockchains and their dapps. IRIS was built on Cosmos SDK. It uses a DPoS-like consensus algorithm called Bonded Proof of Stake (BPoS). The estimated annual yield for staking IRIS reaches 10%.\n\n## Upcoming Ethereum 2.0\n\nEthereum, the second-largest blockchain network out there, is currently transitioning from Proof of Work (PoS) to PoS. Besides becoming a more scalable and flexible network, the new version will allow staking.\n\nThe testnet of ETH 2.0, called Medalla, has been already launched. The transition is carried out in three phases, and it will require a year or two until the infrastructure is fully upgraded. However, staking will become available for everyone earlier than that.\n\nIn order to become eligible to stake ETH, you’ll have to hold at least 32 ETH, which is worth $11,000 based on today’s prices. You will also be required to run a validator node, which can be done on a laptop or regular PC. Besides the high threshold, validators will have to be online regularly or face minor penalties.\n\n## The Final Note\n\nAs Ethereum moves to PoS, the interest in this consensus mechanism will increase. Before that happens, there are many tokens that you can stake right now.\n\nYou can stake multiple tokens through staking pools, wallets that allow staking, or crypto exchanges that offer this service.\n\nWe at OTCTrade.com plan to introduce staking services to our customers next year, though we will provide more details about it as we launch our platform.\n","author":"Anatol Antonovici","authorPhoto":"https://images.ctfassets.net/4x910isj0ns2/3KE1bbmwxCEWutch0Ep5tR/1cdfd5dfd21d54b4375a50153b30eec3/001.jpg","authorOverview":"Anatol is an experienced cryptocurrency journalist and analyst. He has worked for reputable crypto news outlets, including Cointelegraph, Bitconist, CryptoPotato, Cryptovest, u.today, and CCN, among others. Previously, he used to cover traditional markets, including stocks and foreign exchange, providing brokerage firms, asset managers, and other businesses with top-notch content. Anatol is easy-going and passionate about classical music.","date":"12 Nov 2020","metaTitle":"5 Best Tokens to Stake 2020 - OTC Crypto Trade - Crypto News","metaDescription":"The 5 best tokens to stake in 2020: New research has shown us more about crypto traders understanding of staking. Here we rank the top 5 best tokens. ","id":"1csy35RsWIQnN035yAkXQz"},{"title":"Bitcoin Breaks Above $16k For First Time in 3 Years, Institutions Driving the Rally","image":"https://images.ctfassets.net/4x910isj0ns2/2uhWR7GLNFsUeFulxa8TjD/5759a494a17aa559b88b38394cba0355/bitcoin-2643188_1920_1_.jpg","description":"Bitcoin is at it again. The largest cryptocurrency by market cap has broken above $16,000 for the first time in three years, continuing a long-term rally that started in October at less than $11,000. On Thursday, November 12, Bitcoin peaked at $16,166 as per Coinmarketcap data. This is the highest level since January 2018. The coin has surged over 123% year-to-date and about 50% in the current quarter alone. \n\n\nSource: Coinmarketcap.com\n\nWhile it’s hard to accurately explain today’s bullish move, the coin started to rally weeks ago amid intensifying uncertainty triggered by the US election, the second wave of the COVID-19 pandemic, and the stimulus package debate in the US Congress.\n\nThus, institutional investors, who are most likely responsible for driving the price these weeks, regard Bitcoin a good refuge and hedge against inflation, considering that the US might deploy another huge stimulus package now that Democrat candidate Joe Biden won the election. Still, Democrats don’t have the required majority in the Senate, which leaves them with tied hands. Before the election, Democrats [proposed](https://www.cnbc.com/2020/09/24/coronavirus-stimulus-democrats-prepare-new-relief-bill.html) a $2.4 trillion stimulus package, which wasn’t approved by the Trump administration. The White House favored a $1.8 trillion bill.\n\nAfter the victory of Joe Biden, investors expect Democrats to have an influence on the fiscal policy and endorse more inflation in the medium-term to address the economic damage caused by the pandemic. \n\nAnother scenario is that the Fed will be forced to deploy a more aggressive quantitative easing (QE) considering that the next batch of stimulus might come slower due to a divided Congress.\n\nEither way, more cash will likely be injected into the economy sooner or later, and equities along with safe-havens, including Bitcoin, will be pushed further. This is the first time in three years when Bitcoin has a realistic chance to update the all-time high that was touched in December 2017.\n\nAt the end of October, the cryptocurrency broke above $13,000 for the first time since July last year. The move had to do with PayPal’s introduction of crypto services for US customers, on which OTCTrade.com [reported](https://www.otctrade.com/blog/bitcoin-updates-ytd-peak-as-paypal-introduces-cryptocurrency-services) at the time.\n\n## Institutional Investors Buy Bitcoin En Masse\n\nWhile the interest from retail investors is continually growing, especially when more Millenials are forced to stay home and explore new ways to invest, it is institutional investors who are driving the market.\n\nThe so-called whales, large investors who are buying crypto in bulk generally through over-the-counter (OTC) platforms, have been more active in recent weeks, setting the support level at around $15,000. That level has become the new whale support area according to the chart provided by Whalemap:\n\n\n\nSource: whalemap.io\n\nThe whale clusters on the chart show up when high-net-worth individuals (HNWIs) buy BTC and hold it. The price at which those purchases get together is then regarded as a reliable support level.\n\nAs you can see on the chart, most of the large purchases have been conducted in the past few weeks, which demonstrates that the rally has strong momentum and can indeed lead to a new record high soon.\n\nOn November 5, JPMorgan’s Global Markets Strategy released a [report concluding](https://news.bitcoin.com/jpmorgan-gold-etfs-bitcoin/) that more institutional investors were picking Bitcoin over gold exchange-traded funds (ETFs). The analysts said:\n\n> “In our opinion, the ascend of Grayscale Bitcoin Trust suggests that bitcoin demand is not only driven by the younger cohorts of retail investors, i.e. millennials, but also institutional investors such as family offices and asset managers.”\n\n## Prominent Investors Bullish on Bitcoin\n\nEven legendary investors who have managed to make a fortune in traditional markets are now observing the benefits of the cryptocurrency as a store of value.\n\nWall Street investor Bill Miller, founder of investment manager Miller Value Partners, [told](https://www.cnbc.com/video/2020/11/06/i-think-the-markets-telling-you-the-bull-market-continues-legendary-investor-bill-miller.html) CNBC earlier this week that he strongly recommends Bitcoin even at current prices. He called the cryptocurrency the “single best performing asset class” in the current year and the last five and ten years. He said:\n\n> \"Bitcoin has been very volatile, but I think right now it's staying power gets better every day. I think the risks of Bitcoin going to zero are much, much lower than they've ever been before.”\n\nMiller, along with other investors, believes that Bitcoin has consolidated its reputation as “digital gold” amid unprecedented cash injection from central banks and coronavirus spending from governments.\n\nThe legendary investor noted that the inflation was coming back, adding:\n\n> “I think every major bank, every major investment bank, every major high net worth firm is going to eventually have some exposure to Bitcoin or what's like it, which is gold or some kind of commodities.”\n\nAnother reputable investor, billionaire Stanley Druckenmiller, revealed he owned some Bitcoin. He praised the cryptocurrency for its store of value attributes. Druckenmiller [told](https://www.forbes.com/sites/billybambrough/2020/11/12/a-legendary-hedge-fund-billionaire-just-flipped-to-bitcoin-calling-it-better-than-gold/?sh=281a7eeb222f) CNBC last Monday:\n\n> “Bitcoin could be an asset class that has a lot of attraction as a store of value to both millennials and the new West Coast money and, as you know, they got a lot of it.”\n\nThe billionaire also pointed to the upcoming inflation induced by the Fed. He owns a large gold position but said:\n\n> “Frankly, if the gold bet works the bitcoin bet will probably work better because it’s thinner, more illiquid and has a lot more beta to it.”\n\nDruckenmiller and Miller are not isolated voices among traditional investors who are endorsing the cryptocurrency. Wall Street as a whole is finally treating Bitcoin more seriously.\n","author":"Anatol Antonovici","authorPhoto":"https://images.ctfassets.net/4x910isj0ns2/3KE1bbmwxCEWutch0Ep5tR/1cdfd5dfd21d54b4375a50153b30eec3/001.jpg","authorOverview":"Anatol is an experienced cryptocurrency journalist and analyst. He has worked for reputable crypto news outlets, including Cointelegraph, Bitconist, CryptoPotato, Cryptovest, u.today, and CCN, among others. Previously, he used to cover traditional markets, including stocks and foreign exchange, providing brokerage firms, asset managers, and other businesses with top-notch content. Anatol is easy-going and passionate about classical music.","date":"12 Nov 2020","id":"1dq6zpjNhxabxAMsJBHH4r"},{"title":"Bitcoin Escrow Exec Allegedly Defrauded 2 Firms of $7M, How OTCTrade.com Protects Your Funds","image":"https://images.ctfassets.net/4x910isj0ns2/261oKXR1lv5wwPkctGSN8o/683c6abe07a442cfa1a886432e092953/hacking-2964100_1920.jpg","description":"The head of a Bitcoin escrow service was charged with defrauding two companies out of more than $7 million by pledging to conduct Bitcoin purchases on behalf of the firms. Jon Barry Thompson, an Easton man who acts as the principal of crypto escrow firm Volantis Escrow Platform LLC and Volantis Market Making LCC, was charged by a [grand jury](https://www.justice.gov/usao-sdny/pr/principal-cryptocurrency-escrow-company-indicted-7-million-fraudulent-scheme) in the Southern District of New York and by the [US Commodities Futures Trading Commission ](https://www.cftc.gov/PressRoom/PressReleases/8023-19)(CFTC).\n\nThompson has been accused of stealing about $7 million that was paid by two companies willing to purchase Bitcoin. Volantis received the funds in advance in order to buy Bitcoin on behalf of the two clients. The fraudulent schemes took place in 2018 when the cryptocurrency was priced at about $8,000 per coin.\n\nThe Pennsylvanian made false claims, telling companies that “cash is with me, coin is with me,” and saying that “there is no risk of default” since Volantis controlled “both sides of the transaction.” In reality, Thompson sent the funds to a third-party escrow service that never bought the pledged Bitcoin or returned the funds. Thompson used sophisticated terms to confuse clients, and falsely claimed that the Bitcoin transactions would be settled via an “atomic swap process.” In both instances, he lied to the firms for several days regarding the status of their cash and Bitcoin, neither of which was returned.\n\nManhattan US Attorney Geoffrey S. Berman commented: \n\n> “As alleged, Jon Barry Thompson repeatedly lied to investors in cryptocurrencies about the safety of their investments made through his companies. As a result of Thompson’s lies, investors lost millions of dollars.”\n\nAccording to the Justice Department, Thompson is charged with two counts of commodities fraud, each of which implies a maximum sentence of 10 years in prison, and two counts of wire fraud, each of which carries a maximum sentence of 20 years in prison. He [pled](https://cointelegraph.com/news/exec-who-bamboozled-clients-with-crypto-jargon-pleads-guilty-to-3-25m-fraud) guilty to one count of commodities fraud and will face sentencing on January 7 next year.\n\nCFTC Director of Enforcement James McDonald noted that:\n\n> “Fraudulent schemes, like that alleged in this case, undermine the integrity of new and innovative markets and cheat innocent people out of their hard-earned money.”\n\nThe CFTC took action because Bitcoin was determined to be commodities under the CommodityExchange Act (CEA). Thus it falls under the supervision of the CFTC in the case the cryptocurrency is used in derivatives trading or fraud and manipulation.\n\nThe CFTC seeks restitution of all funds, civil monetary penalties, permanent trading and registration bans, and “a permanent injunction against further violations of the Commodity Exchange Act and CFTC regulations.”\n\n## How Does OTCTrade.com Safeguard Your Funds?\n\nAs McDonald noted, frauds like this do not bode well for the nascent cryptocurrency space. We at OTCTrade.com provide a safe environment to carry out medium and large cryptocurrency trades. Our trading desks, as well as all customers, are verified before onboarding the platform. On top of that, we have [partnered with](https://cointelegraph.com/press-releases/otctradecom-launches-otc-crypto-trading-platform-with-5-mm-insurance) PrimeTrust, a reputable custodian that enables us to provide clients with $5 million insurance per each account to cover unpleasant situations like theft and hacking attacks.\n\nOTCTrade.com offers instant settlement, so clients don’t need to wait for hours or days worrying about their funds.\n\nBefore trusting their millions, institutional investors and large traders must conduct due diligence because the crypto space is still targeted by scammers and fraudsters. It would be best if you worked with regulated and reputable services.\n","author":"Anatol Antonovici","authorPhoto":"https://images.ctfassets.net/4x910isj0ns2/6HC9qN9KlhDdCLEJUlfKhu/f4f12832fb4d62c62643ad5f01684e42/001.jpg","authorOverview":"Anatol is an experienced cryptocurrency journalist and analyst. He has worked for reputable crypto news outlets, including Cointelegraph, Bitconist, CryptoPotato, Cryptovest, u.today, and CCN, among others. Previously, he used to cover traditional markets, including stocks and foreign exchange, providing brokerage firms, asset managers, and other businesses with top-notch content. Anatol is easy-going and passionate about classical music.","date":"04 Nov 2020","metaTitle":"Bitcoin Exec Defrauds Firms - See How OTCTrade Protects You - Crypto News","metaDescription":"The head of a Bitcoin escrow service was recently charged with defrauding 2 firms of $7 million. See how the OTCTrade.com platform protects your crypto assets.","id":"3AsWLG2VAsKoCpcKTNbaZU"},{"title":"SEC Green-Lights Streamlined Process for Digital Asset Settlement","image":"https://images.ctfassets.net/4x910isj0ns2/S814xonp83fb1N2tkiQSe/11bcc8c9eafb1221285dac51d3544aeb/right-4926156_1920.jpg","description":"The US Securities and Exchange Commission (SEC) issued a [no-action letter ](https://www.sec.gov/divisions/marketreg/mr-noaction/2020/finra-ats-role-in-settlement-of-digital-asset-security-trades-09252020.pdf)to the Financial Industry Regulatory Authority (FINRA), bringing more clarity on how alternative trading systems (ATSs) should settle digital asset security trades. The move is expected to simplify and speed up the settlement of digital asset securities by cutting the previous four-step process to three, which would reduce the operational risk for regulated broker-dealers.\n\nThe SEC’s Division of Trading and Markets said in the letter issued on September 25, 2020, that broker-dealers are allowed to stick to a three-step settlement for digital asset securities stored in a third-party’s custody if certain conditions are met.\n\nPreviously, broker-dealers operating ATSs had to follow a [four-step ](https://www.sec.gov/news/public-statement/joint-staff-statement-broker-dealer-custody-digital-asset-securities)settlement process as described below:\n\n- Step 1 – buyers and sellers send their orders to the ATS;\n- Step 2 – the ATS matches the orders;\n- Step 3 – the ATS notifies the buyer and seller of the matched trade;\n- Step 4 – the buyer and seller settle the transaction bilaterally, either directly with each other or by requiring their respective custodians to settle the transaction on their behalf.\n\nAccording to the SEC, many ATSs would like to follow a more straightforward process in cases where there is no custody. They proposed a three-step model as follows:\n\n- Step 1 – The buyer and seller send their respective orders to the ATS, notify their respective custodians of their respective orders submitted to the ATS, and instruct their respective custodians to settle transactions in accordance with the terms of their orders when the ATS notifies the custodians of a match on the ATS;\n- Step 2 – The ATS matches the orders; and\n- Step 3 – The ATS notifies the buyer and seller and their respective custodians of the matched trade and the custodians carry out the conditional instructions.\n\nConsequently, the custodians would then settle the digital securities trades on behalf of buyers and sellers based on the instructions received as part of Step 1.\n\nWhile the current three-step settlement process is a significant improvement, the SEC noted that the no-action letter *“solely addresses an ATS trading digital asset securities under the circumstances set forth in this letter and does not otherwise address broker-dealer custody or control of digital asset securities.”*\n\nATSs are SEC-regulated electronic trading systems that match orders for buyers and sellers of securities, including digital ones. An ATS may seek the SEC’s nod to become a national securities exchange. All existing ATSs operate like dark pools, meaning that their trading systems enable users to place orders without publicly showing the price and size of their orders to the rest of the participants in the market.\n\nFINRA is a private corporation that acts as a self-regulatory entity that cooperates with the SEC, supervising broker-dealers.\n\nThe SEC has intensified its efforts to regulate blockchain-based securities, while the Commodity Futures Trading Commission (CFTC) is focusing on Bitcoin. However, the US still doesn’t have a comprehensive regulatory framework aimed at cryptocurrencies. Elsewhere, the European Union [may become](https://www.otctrade.com/blog/european-commission-proposes-extensive-regulatory-framework-for-crypto-assets) the first major jurisdiction to have an extensive regulation for all crypto processes.\n","author":"Anatol Antonovici","authorPhoto":"https://images.ctfassets.net/4x910isj0ns2/3KE1bbmwxCEWutch0Ep5tR/1cdfd5dfd21d54b4375a50153b30eec3/001.jpg","authorOverview":"Anatol is an experienced cryptocurrency journalist and analyst. He has worked for reputable crypto news outlets, including Cointelegraph, Bitconist, CryptoPotato, Cryptovest, u.today, and CCN, among others. Previously, he used to cover traditional markets, including stocks and foreign exchange, providing brokerage firms, asset managers, and other businesses with top-notch content. Anatol is easy-going and passionate about classical music.","date":"04 Nov 2020","metaTitle":"SEC Green-Lights Digital Asset Settlement - OTC Trade Crypto News","metaDescription":"As the US SEC issued a no-action letter with the potential to reduce OTC trade risk and make the process simpler and faster. Read more at OTCtrade.com.","id":"6RIaQWdybRn2o34kMhnysq"},{"title":"Bitcoin Updates YTD Peak as PayPal Introduces Cryptocurrency Services","image":"https://images.ctfassets.net/4x910isj0ns2/2cYaOHWlKUPxA6Ldds8zp0/c949e3f90f92f923030b94e9b364c988/bitcoin-3890350_1920.jpg","description":"Bitcoin updated the year-to-date high as of mid-October and is about to break above $13,000 for the first time since July 2019. If it manages to add a few more hundred, the largest cryptocurrency by market cap will hit the highest since January 2018.\n\nWhile the bullish move started earlier this week, the rally intensified on Wednesday, October 21, after PayPal [announced](https://newsroom.paypal-corp.com/2020-10-21-PayPal-Launches-New-Service-Enabling-Users-to-Buy-Hold-and-Sell-Cryptocurrency) that its US customers would be able to buy, sell, and hold Bitcoin and other cryptocurrencies through its online wallets. Besides this, PayPal users will be able to use digital currencies to shop at the 26 million merchants on its network starting from next year.\n\nBitcoin critics have constantly pointed to its lack of utility, which hinders the cryptocurrency’s wider adoption. The move from the payment giant will allow it to go mainstream. PayPal noted that the interest in cryptocurrencies has increased amid the COVID pandemic.\n\nDan Schulman, president and CEO of PayPal, commented:\n\n> “The shift to digital forms of currencies is inevitable, bringing with it clear advantages in terms of financial inclusion and access; efficiency, speed and resilience of the payments system; and the ability for governments to disburse funds to citizens quickly.”\n\nSchulman went further by expressing the company’s readiness to collaborate with central banks and regulators worldwide to provide its support and contribution to “shaping the role that digital currencies will play in the future of global finance and commerce.”\n\nThat means PayPal will improve its infrastructure to allow new digital currencies that may be created by central banks and corporations.\n\nIn a [previous opinion article](https://www.otctrade.com/blog/cryptocurrencies-will-put-an-end-to-fiat-money-here-is-how-it-will-happen) that discusses the end of fiat currencies and their replacement with digital coins, we mentioned that one of the main conditions for crypto adoption is that virtual coins like Bitcoin reach the payment market. PayPal’s move is speeding up this process. The company has almost 350 million active accounts worldwide and processed over $220 billion in payments in the second quarter of 2020. \n\nPayPal said that crypto payments would be settled via fiat currencies, like the US dollar, suggesting that merchants will not receive payments in Bitcoin.\n\nThe payment service is introducing the crypto feature in partnership with Paxos Trust Company, which operates a crypto exchange and stablecoin. Initially, PayPal accepts operations with Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.\n\n## PayPal Move Boosts Bitcoin Price\n\nAt the time of writing on October 21, Bitcoin is trading at over $12,800, gaining over 7.1% for the day. It has already updated the YTD peak at over $12,850 and is close to breaking above $13,000, which could send prices to the highest since January 2018.\n\nIt’s worth mentioning that Bitcoin has been already bullish when the PayPal announcement came out. The cryptocurrency broke above $12,000 on Tuesday. It gained about 13% on the week.\n\nThe $12,000 mark should be a resilient support level under the bulls’ domination.\n\nBesides the PayPal-induced frenzy, the cryptocurrency might leverage its safe-haven status amid increasing political and economic uncertainty, as the number of COVID infections continues to increase, forcing many countries to reimpose lockdown measures. Also, the US election might turn out chaotic, as current President Donald Trump said he wouldn’t give up power peacefully in the case he loses. Nevertheless, the polls show that he might lose indeed, as Democrat candidate Joe Biden is leading with a margin.\n\nAs of mid-October, Bitcoin is decoupling from macro assets like stocks, gold, and fiat currencies. Here is how the cryptocurrency performance since March nosedive compares to the S&P 500, Nasdaq, and gold:\n\n\n\nIt remains to be seen if the current bullishness remains for a longer period, but the fact that Bitcoin and other major digital coins will have some real use cases would definitely play a role in shaping future price trends.\n","author":"Anatol Antonovici","authorPhoto":"https://images.ctfassets.net/4x910isj0ns2/3KE1bbmwxCEWutch0Ep5tR/1cdfd5dfd21d54b4375a50153b30eec3/001.jpg","authorOverview":"Anatol is an experienced cryptocurrency journalist and analyst. He has worked for reputable crypto news outlets, including Cointelegraph, Bitconist, CryptoPotato, Cryptovest, u.today, and CCN, among others. Previously, he used to cover traditional markets, including stocks and foreign exchange, providing brokerage firms, asset managers, and other businesses with top-notch content. Anatol is easy-going and passionate about classical music.","date":"21 Oct 2020","metaTitle":"Bitcoin Sees YTD Peak with PayPal Cryptocurrency Services","metaDescription":"Bitcoin updated the year-to-date high as of mid-October, poised to break above $13,000 after the introduction of PayPal Cryptocurrency Services.","id":"CYdGqsK9R5OQKU1UmlnPQ"},{"title":"Russia Getting Tough on Cryptocurrency, Holders Might Have to Report Transactions & Addresses","image":"https://images.ctfassets.net/4x910isj0ns2/35NZxDNCEpEnoi3On92rc/561203f176e8a3fe15882e33614352dc/the-flagpole-2877540_1920.jpg","description":"Russia’s Ministry of Finance proposed amendments to the current draft bill regulating cryptocurrencies that would require citizens to report crypto transactions and wallet addresses to tax authorities if the wallet turnover exceeds 100,000 rubles (about $1,300) per year, [according to ](https://www.rbc.ru/crypto/news/5f6c49079a79474d36bc852b?from=main)local media RBK. If they fail to abide by requirements in the case the amendments take effect, cryptocurrency holders may pay 30% of their holdings in fines or even face up to three years in prison in the case the wallet’s annual turnover exceeds 1 million rubles ($13,000). Using cryptocurrency for financial crimes could lead to more severe punishments.\n\nAlso, the proposal requires over-the-counter (OTC) cryptocurrency dealers and crypto exchanges to report all transactions that involve the ruble – the local fiat currency – and Russian IP addresses to tax authorities.\n\nWhile the latest proposals are obviously harsh, they look mild compared to the previous draft bill that sought up to seven years in prison for those who facilitate cryptocurrency transactions. In fact, the previous bill banned crypto operations at all. That draft failed to become law after strong resistance from the crypto community, along with support from the Ministry of Justice and Ministry of Economic Development. Critics of the previous draft said that it could have put an end to the blockchain development in Russia.\n\nThe Minister of Finance’s latest amendments to the Law of Digital Financial Assets concern changes to the Criminal and Criminal Procedure Codes, the Code of Administrative Offenses, the Tax Code and the Law on Combating Legalization (Laundering) of Incomes.\n\nThe new draft recommends cryptocurrencies to be considered property in order to be taxed. The Finance Ministry noted that digital currencies are often used for tax evasion, money laundering and illegal activities.\n\nThe Law of Digital Financial Assets was signed by President Vladimir Putin at the end of July 2020 and comes into force in January 2021. If the new amendments get the nod of parliament, they will also take effect in January. So far, the current bill approved by the State Duma (the lower house of the parliament) permits crypto transactions but doesn’t allow buying and selling goods and services with it on the Russian territory.\n\n## Sell Crypto Now If You Can’t Explain Its Origin, Expert Recommends\n\nMoscow Digital School expert Efim Kazantsev told RBK that those who decide to keep the existing cryptocurrency and report it to the tax authorities when the law takes effect will have to answer questions about its origin and whether all taxes had been paid from it. He said:\n\n> “There is, of course, the likelihood that this overly tough initiative of the Ministry of Finance will not be supported, but there are not many chances for this. Most likely, in one form or another, the obligation to declare cryptocurrency will be consolidated. This means that everyone who does not plan to tell tax authorities about the sources of their cryptocurrency’s origin and the reasons for non-payment of taxes should think about converting it into something else.”\n\n## Deputy Would Rather Block Cryptocurrency Than Regulate It\n\nWhat’s even worse for the crypto community, some influential politicians still seek to block cryptocurrency operations at all. Anatoly Aksakov, Chairman of State Duma Committee on Financial Market, who contributed to the creation of the draft of the Law on Digital Financial Assets, [told](https://www.rbc.ru/crypto/news/5f6df25e9a794788b30121ac) RBK that cryptocurrencies should not be legalized at all. He argues that crypto assets are mainly used by those who seek to hide their operations from government oversight, whether they buy narcotics, bribe officials or legalize capital obtained through criminal activities. Aksakov said:\n\n> “Do we need to legalize this form of exchange of fiat currencies to cryptocurrencies if they are mainly used for dubious transactions? Not always, of course. In my opinion, the overwhelming majority of them are used to finance something illegal.”\n\nHe added that digital currencies like Bitcoin are used as a [store of value ](https://www.otctrade.com/blog/bitcoin-as-store-of-value)or for speculative purposes only by a small proportion of non-professional investors. According to the deputy, cryptocurrency carries significant risks and has uncertain prospects, so it is not attractive as an investment.\n\n> “Nothing convinces me yet that cryptocurrency is a means of accumulating capital,” Aksakov noted, adding that cryptocurrencies, in principle, cannot be regulated.\n\nThe deputy admits that once the Law on Digital Financial Assets comes into effect, it will permit the use of cryptocurrencies, stablecoins, and smart contracts. However, he is now seeking to limit everything related to cryptocurrencies, which is weird, considering that he participated in the creation of the bill in the first place. He stressed:\n\n> “We do not want to legalize this because we do not want to stimulate the flow of money to carry out illegal operations.”\n\nInterestingly, Russia’s Federal Service for Supervision of Communications, Information Technology and Mass Media (Roskomnadzor) [blacklisted](https://www.rbc.ru/crypto/news/5f6d92799a794754dd63bbc1) the website of Binance, one of the largest crypto exchanges. The telecom regulator claims that the site contains information prohibited for distribution in Russia, making reference to the possibility of buying Bitcoin and other digital assets. Still, Russian residents can use the exchange freely.\n","author":"Anatol Antonovici","authorPhoto":"https://images.ctfassets.net/4x910isj0ns2/6HC9qN9KlhDdCLEJUlfKhu/f4f12832fb4d62c62643ad5f01684e42/001.jpg","authorOverview":"Anatol is an experienced cryptocurrency journalist and analyst. He has worked for reputable crypto news outlets, including Cointelegraph, Bitconist, CryptoPotato, Cryptovest, u.today, and CCN, among others. Previously, he used to cover traditional markets, including stocks and foreign exchange, providing brokerage firms, asset managers, and other businesses with top-notch content. Anatol is easy-going and passionate about classical music.","date":"14 Oct 2020","metaTitle":"Russia Tightens Cryptocurrency Regulations, New Reports and Taxes - Crypto News","metaDescription":"Russia announced new cryptocurrency regulations requiring reports of crypto trades, wallets, and potential taxes on OTC crypto trade.","id":"1kA8t3vK2y1vxNEHWRRtHG"},{"title":"China’s PBOC Blacklists OTC Dealers, Imposes 5-Year Banking Restrictions","image":"https://images.ctfassets.net/4x910isj0ns2/2Q9qsUKyqgGjq2ej64aKk6/ec0b1fe0fc4c85f2050b8bc4188f550f/ancient-1866754_1920.jpg","description":"The People’s Bank of China (PBoC) is blacklisting over-the-counter (OTC) trading desks and individual traders suspected of money laundering and other illicit activities, according to [local media](https://mp.weixin.qq.com/s?__biz=MzI0ODgzMDE5MA==&mid=2247486552&idx=1&sn=e9f0cf4f5c075bc1fa92396415252a85&chksm=e99b8dd9deec04cf0597e1b00874df7fca55dee80acce272d1c8eb61a3b95c269a4df0e4f378&token=856874707&lang=zh_CN#rd). The blacklisted entities will see their banking accounts suspended for five years. Also, they will not be able to use debit and credit cards issued by any bank for a period of three years.\n\nMany crypto OTC dealers are already halting activities as they fear repercussions. Still, industry insiders claim that normal cryptocurrency sales are not causing any suspicions. Crypto exchange Huobi, which provides an OTC desk, seems not to be deranged by the new rules. The company said: \n\n> “Normal cryptocurrency transactions are not illegal, and only those involving black money and illicit assets will be frozen.”\n\nAs for OTC dealers that operate larger traders, they can most likely end up in the blacklist. The process goes like this: when a bank’s risk system detects a suspicious account, it flags it and restricts transactions. Then it reports the account to the central bank. Finally, the PBoC is sharing all blacklisted accounts across banks in all regions, thus making sure that OTC dealers cannot open new accounts in other Chinese provinces.\n\nOn September 18, the Guangxi Public Security Bureau and the Nanning Central Branch of the PBoC announced the first batch of 1091 individuals who are eligible for the punishment. Authorities from other locations, including Quanzhou, Putian, Wenzhou, and Laibin, have also released lists of suspected entities.\n\nGuangxi, an autonomous region bordered by Vietnam, is the home of multiple money laundering cases. In May, a crypto OTC merchant operating in the region’s capital city of Nanning [was suspected](https://mp.weixin.qq.com/s?__biz=MzI0ODgzMDE5MA==&mid=2247485030&idx=1&sn=6c3b900a2953755319351fd6147fa779&chksm=e99b87e7deec0ef1b4e8c28edbe846a7201c663b517c060e5bd9fa84b284f7ac6f8411fc40f1&scene=21#wechat_redirect) of helping money laundering conducted by criminals involved in telecommunications and online frauds.\n\nAlthough Huobi and other crypto businesses might indirectly hint that it’s not that difficult to distinguish the wrong transactions from the permitted ones, the truth is that there is a lack of clear rules across Chinese banks. This means that any OTC business can end up in the blacklist no matter how hard it tries to act according to the law. Moreover, China has no clear rules on cryptocurrencies either, even though it is gradually deploying its own digital Yuan issued by the PBoC itself.\n\nChina going hard on the crypto industry is not a novelty. In 2017, Beijing [banned](https://www.forbes.com/sites/kenrapoza/2017/11/02/cryptocurrency-exchanges-officially-dead-in-china/#620ed3df2a83) initial coin offerings (ICO) and local crypto exchanges. Despite the crackdown, the Beijing Arbitration Commission [explained](https://www.bjac.org.cn/news/view?id=3769) a few months ago that the government hadn’t ban Bitcoin as a digital commodity.\n","author":"Anatol Antonovici","authorPhoto":"https://images.ctfassets.net/4x910isj0ns2/3KE1bbmwxCEWutch0Ep5tR/1cdfd5dfd21d54b4375a50153b30eec3/001.jpg","authorOverview":"Anatol is an experienced cryptocurrency journalist and analyst. He has worked for reputable crypto news outlets, including Cointelegraph, Bitconist, CryptoPotato, Cryptovest, u.today, and CCN, among others. Previously, he used to cover traditional markets, including stocks and foreign exchange, providing brokerage firms, asset managers, and other businesses with top-notch content. Anatol is easy-going and passionate about classical music.","date":"09 Oct 2020","metaTitle":"China Blacklists OTC Dealers - OTC Trade - Crypto News ","metaDescription":"The People's Bank of China blacklists OTC dealers, including over-the-counter trading desks under suspicion of money laundering.","metaKeywords":"OTC dealers","id":"5RopABo6McLJa1wp7195ZN"},{"title":"European Commission Proposes Extensive Regulatory Framework for Crypto Assets","image":"https://images.ctfassets.net/4x910isj0ns2/28RcpzK7iUV8mbFLMLShtt/5f620fc73bd01eb27e021f774f699397/belgium-3595351_1920.jpg","description":"While Russia and China are tightening regulations on cryptocurrency-related operations, the European Union becomes the first major jurisdiction to provide a comprehensive framework that is supportive and is aimed at the development of the cryptocurrency industry. At the end of September 2020, the European Commission [released](https://ec.europa.eu/finance/docs/law/200924-crypto-assets-proposal_en.pdf) the most extensive document discussing the supervision of the emerging cryptocurrency sector.\n\nThe so-called Regulation on Markets in Crypto Assets (MiCA) touches upon all cryptocurrencies and tokens, including stablecoins. Many articles of the 167-page document import financial terms and principles from the traditional financial services and apply them to the crypto space. The draft regulation is part of the [Digital Finance package](https://ec.europa.eu/commission/presscorner/detail/en/IP_20_1684), which includes a set of measures designed to support the potential of digital finance to foster innovation and regulate competition. \n\nThe proposal lists four main objectives as follows:\n\n- __Provide legal certainty__ – the Commission concluded that in order for crypto-asset markets to develop within the European bloc, they need a sound legal framework that would define the regulatory treatment of all crypto assets.\n- __Support innovation__ – the EU aims to promote the development of crypto-assets and the wider use of blockchain by establishing a safe and well-balanced framework to support innovation and fair competition.\n- __Provide consumer and investor protection__ – cryptocurrencies are not covered by existing financial services regulations, which hinders the wider adoption among consumers.\n- __Ensure financial stability__ – the European Commission highlighted the potential use of stablecoins, which can become widely accepted and systemic. Accordingly, the proposal comprises safeguards to address potential risks to financial stability that relate to the emergence of stablecoins.\n\nIt’s worth mentioning that unlike directives, such as the recent [Payment Services Directive PSD2](https://ec.europa.eu/info/law/payment-services-psd-2-directive-eu-2015-2366_en), the current proposal is a regulation, suggesting that it is not for interpretation in the individual EU countries but must be implemented in all EU countries the way the European Parliament adopts it. Still, there is a long way until MiCA becomes law and the Commission hopes the framework will be implemented by 2024. The EU Commission will release the final version of the MiCA proposal in a few weeks.\n\nValdis Dombrovskis, executive VP of the EU Commission, said in a statement:\n\n> “We must proactively embrace digital transformation, while mitigating any potential risks. A digital and innovative single market for finance will benefit Europeans and be key to Europe's economic recovery by delivering better financial products for consumers and opening up new financing channels for businesses.”\n\n## MiCA Provides Legal Definitions and Highlights Stablecoins\n\nThe MiCA document starts with the definitions of what is a crypto asset and what are other token subcategories. It also establishes rules for cryptocurrency custody and capital requirements as well as the relationship between token issuers and holders.\n\nA great emphasis is placed on stablecoins, as many EU leaders had previously expressed concerns on Facebook’s Libra. At the beginning of September, Reuters [reported](https://www.reuters.com/article/us-eu-economy-cryptoassets/big-european-states-call-for-cryptocurrency-curbs-to-protect-consumers-idUSKBN26219G) that Germany, France, Italy, Spain and the Netherlands urged the EU Commission to come up with strict regulation for asset-backed digital assets such as stablecoins in order to protect consumers and defend state sovereignty in monetary policy. After an informal meeting between the states, German Finance Minister Olaf Scholz told media:\n\n> “We all agree that it’s our task to keep financial market stable and to ensure that what is a task for states remains a task for states.”\n\nThe finance ministers of the five countries said that stablecoins should not be permitted to operate on EU territory until a clear framework is established.\n\nThe ministers want all entities involved in a stablecoin project to be registered in the EU. If this becomes law, it can impact Facebook’s Libra since the upcoming token will be governed by the Geneva-based Libra Association.\n\nAlso, the five major countries propose that all stablecoins be pegged at a ratio of 1:1 with fiat currency, including the euro or other currencies of European states. The fiat reserves should be deposited in an institution approved by the EU.\n\n## What Does MiCA Define and Stipulate?\n\nThe EU Commission defines a crypto asset as “a digital representation of value or rights, which may be transferred and stored electronically, using distributed ledger or similar technology.” The document also defines stablecoins subcategories such as electronic money token (e-money token) and asset-referenced token along with the utility token.\n\nThe proposal then dives into the activities of custodian services and cryptocurrency exchanges along with other crypto service providers.\n\nSpecial attention is given to cryptocurrency and token issuers, which have to come up with a whitepaper in the first place. Many articles of MiCA are dedicated to the scope and attributes of a whitepaper. The document also discusses the marketing approaches and other rules related to the promotion of a newly issued digital asset. The goal is to protect consumers and ensure fair competition.\n\nCryptocurrency service providers, such as custodians and exchanges, including over-the-counter (OTC) trading desks, should also consider a wide list of rules before operating in the EU, providing that the proposal becomes law. Services providers will have to cooperate and report to the European Supervisory Market Authority (ESMA) and the European Banking Authority (EBA). They will have to get a license and become part of a supervisory regime that is similar to MiFID II, which regulates the traditional financial markets.\n\nAll in all, there are a lot of rules to follow, but the framework doesn’t intend to hinder the expansion of the crypto space. Also, it’s worth noting that the EU Commission’s proposal doesn’t touch upon digital currencies issued by central banks.\n","author":"Anatol Antonovici","authorPhoto":"https://images.ctfassets.net/4x910isj0ns2/3KE1bbmwxCEWutch0Ep5tR/1cdfd5dfd21d54b4375a50153b30eec3/001.jpg","authorOverview":"Anatol is an experienced cryptocurrency journalist and analyst. He has worked for reputable crypto news outlets, including Cointelegraph, Bitconist, CryptoPotato, Cryptovest, u.today, and CCN, among others. Previously, he used to cover traditional markets, including stocks and foreign exchange, providing brokerage firms, asset managers, and other businesses with top-notch content. Anatol is easy-going and passionate about classical music.","date":"09 Oct 2020","metaTitle":"European Commission Proposes Extensive Regulatory Framework for Crypto Assets - Crypto News","metaDescription":"As other countries tighten regulations on crypto assets, the European Commission built a framework to support cryptocurrencies.","metaKeywords":"crypto assets\neuropean commission","id":"6pdRhDlD73DCg4fl0NtoF9"},{"title":"Bitcoin as Store of Value","image":"https://images.ctfassets.net/4x910isj0ns2/1IcLzinmlOMj2uMoOA0ZUZ/bdbcd127c780c806d6424303ff403b5f/image_6_.jpg","description":"Bitcoin’s safe haven capabilities have been discussed a lot this year given the economic crisis caused by the COVID-19 pandemic. However, is the cryptocurrency really that good at storing value in the long-term? Let’s find out!\n\n## COVID Crisis Highlights Bitcoin’s Safe-Haven Potential\n\nIn a [previous article](https://www.otctrade.com/blog/btc,-gold-rallying-amid-failing-global-economy,-dovish-stance), we discussed that Bitcoin and gold had been both rallying in July, driven by investors’ fears that fiat money was gradually devaluing due to the huge stimulus packages implemented by governments and central bankers.\n\nIn the first half of the year, investors overreacted to the news about the coronavirus outbreak, with the CBOE Volatility Index (VIX) hitting the second-highest level on record as of mid-March. The volatility of all assets, including Bitcoin, surged as bears were focusing on the shocking economic crisis caused by the pandemic, while bulls were trying to price in the upcoming recovery.\n\nIndeed, the pandemic caused an unprecedented crisis in almost all countries. The US gross domestic product (GDP) tumbled in the second quarter of 2020 at an annualized rate of 32.9%, the deepest drop since records started in 1947. The economy fell almost 10% year-on-year in the three months to June. There were 30.2 million US citizens receiving unemployment benefits in the week ending July 11, with the unemployment rate jumping from 3.7% to over 10%.\n\n\n\nSource: https://www.bea.gov/system/files/gdp2q20_adv_chart.png \n\nMost countries are experiencing or are on the brink of recession, which occurs when the GDP is contracting for two consecutive quarters.\n\n\n\nSource: https://www.bbc.com/news/business-51706225 \n\nObviously, such a gloomy picture is putting most governments in an awkward position. Central bankers have no choice than to reduce interest rates close to zero and inject as much cash as possible. The [Fed’s balance sheet](https://fred.stlouisfed.org/series/WALCL), which was below $1 trillion up until the financial crisis in 2008, gradually rose to over $4 trillion as of January 2020 and jumped to over $7 trillion as of mid-June. The US central bank’s dynamic of the balance sheet indirectly shows how much dollar bills are printed.\n\nCentral bankers are injecting free cash to support the failing economies. While this might have the desired effect, at least in the short-term, investors are concerned about the devaluation of fiat money. Their focus turned to assets that can store value in the long-term, and Bitcoin might be one of the best options.\n\nGiven that the Fed has been among the most active central banks at printing money, the US dollar is losing its purchasing power, with the [USD index](https://www.bloomberg.com/quote/DXY:CUR), which tracks the greenback against six other major currencies, falling to the lowest in two years. Investors also fear that the US dollar would eventually lose its world reserve currency status, which has been around since the Bretton-Woods agreement in 1944.\n\n## More People Are Investing in BTC\n\nThe economic conditions and the aggressive stimulus packages have prompted a rush to safe havens. Bitcoin is also benefiting from its safe haven status.\n\nAs per UsefulTulips, which merges data from LocalBitcoin and Paxful – two largest cryptocurrency peer-to-peer (P2P) exchanges aimed at retail traders – Bitcoin trading volume hit a record high in North America as of mid-July.\n\n\n\nhttps://www.usefultulips.org/combined_North%20America_Page.html\n\nA similar trend could be observed in countries like India, Vietnam, Mexico, Chile, Bolivia, Nigeria, South Africa, Ghana, and Kenya, among others. This demonstrates that regular people indeed are betting on Bitcoin as they are looking for reliable assets to hedge against inflation.\n\nBoth retail and institutional investors are considering the cryptocurrency as it is playing the safe-haven card.\n\n## Why Is Bitcoin a Good Store of Value?\n\nBitcoin is often called digital gold – and for very good reason. The scarcity of the oldest cryptocurrency out there, thanks to its deflationary model, is making it a good candidate among assets that act as a store of value (SOV).\n\nIn July, investment behemoth Fidelity released [a report](https://www.fidelitydigitalassets.com/bin-public/060_www_fidelity_com/documents/FDAS/bitinvthessisstoreofvalue.pdf), claiming that Bitcoin was an “aspirational store of value” and an “insurance policy” in moments of crisis.\n\nAs per Fidelity Digital Assets, Bitcoin hasn’t reached the level of acceptance as an SOV yet, but it has all the prerequisites. The report reads:\n\n> “Many investors consider bitcoin to be an aspirational store of value in that it has the properties of a store of value but has yet to be widely accepted as such.”\n\nHistorically, the four key elements that described a good SOV have been scarcity, portability, durability and divisibility, and Bitcoin has all of them. According to Fidelity, one of the essential characteristics that make Bitcoin a good SOV is its digital scarcity. As you might know, the cryptocurrency’s maximum supply is capped by the protocol at 21 million. Currently, the circulating supply is almost 18.5 million, according to [Coinmarketcap](https://coinmarketcap.com) data. It means that 2.5 million more coins have to be mined and there will be no more generation of new Bitcoin. Since the mining difficulty increases over time, the circulating supply is expanding at a much slower pace compared to the first years.\n\n\n\nFidelity cited the popular stock-to-flow model, which is calculated by dividing the current supply of the asset by the number of coins or units produced in a given period, e.g. a day, week or month. The indicator reflects the degree of scarcity or abundance of an asset. At the moment, Bitcoin is the second-scarcer asset after gold, but the cryptocurrency will exceed the metal by 2025.\n\n\n\nThe Fidelity report also discusses Bitcoin’s decentralization, which preserves people’s trust in the cryptocurrency. Transactions on blockchain are immutable, meaning that it is economically and computationally close to impossible to even try to reverse transactions and rearrange blocks.\n\nGiven that the supply side of the cryptocurrency is stable and predictable, it is the demand side that will drive prices in the future. The report reads:\n\n> “Investors believe that the next wave of awareness and adoption could be driven by external factors such as unprecedented levels of intervention by central banks and governments, record low interest rates, increasing fiat money supply, deglobalization and the potential for ensuing inflation, all of which have been accelerated by the pandemic and economic shutdown.”\n\nLegendary investor and billionaire Paul Tudor of Tudor Investment Corporation [told](https://www.cnbc.com/2020/05/11/paul-tudor-jones-calls-bitcoin-a-great-speculation-says-he-has-almost-2percent-of-his-assets-in-it.html) CNBC that Wall Street might be witnessing the historic “birthing of a store of value” through Bitcoin. He called government-backed cash “a wasting asset,” as the central banks of most countries have an “avowed goal of depreciating its value 2% per year.”\n\nThe billionaire revealed that he allocated just over 1% of his assets to Bitcoin. In May 2020, Paul Tudor and Lorenzo Giorgianni, head of research at Tudor Investment Corporation, presented the case of Bitcoin in an investor letter titled “The Great Monetary Inflation.”\n\nHis team scored financial assets based on four characteristics that define SOVs: purchasing power, trustworthiness, portability and liquidity. Tudor [hinted](https://www.institutionalinvestor.com/article/b1mmvg200ctlr0/Wall-Street-s-Crypto-Cold-War) that the price of Bitcoin should be much higher:\n\n> “Bitcoin had an overall score of nearly 60 percent of that of financial assets, but has a market cap that is 1/1,200th of that. It scores 66 percent of gold as a store of value but has a market cap that is 1/60th of gold’s outstanding value. Something appears wrong here, and my guess is it is the price of bitcoin.”\n\nThe only major concern of those skeptical about Bitcoin’s SOV status is the high volatility of the cryptocurrency. However, the crypto market is still at an emerging phase, as the Bitcoin whitepaper was released only about a decade ago. When US President Richard Nixon announced in 1971 the end of the US dollar convertibility to gold, the metal started to fluctuate wildly in the following months and years, but that doesn’t mean it wasn’t a good SOV. \n\nAll in all, Bitcoin was designed as a means of payment, but institutional investors would rather use it as an SOV. The cryptocurrency is scarce, portable, divisible, durable, and liquid – what can you expect more? We have to wait for the market to mature and experience a wider adoption worldwide and there will be even fewer critics of Bitcoin’s SOV capabilities.\n","author":"Anatol Antonovici","authorPhoto":"https://images.ctfassets.net/4x910isj0ns2/3KE1bbmwxCEWutch0Ep5tR/1cdfd5dfd21d54b4375a50153b30eec3/001.jpg","authorOverview":"Anatol is an experienced cryptocurrency journalist and analyst. He has worked for reputable crypto news outlets, including Cointelegraph, Bitconist, CryptoPotato, Cryptovest, u.today, and CCN, among others. Previously, he used to cover traditional markets, including stocks and foreign exchange, providing brokerage firms, asset managers, and other businesses with top-notch content. Anatol is easy-going and passionate about classical music.","date":"30 Sep 2020","metaTitle":"Crypto News | Is Bitcoin a Good Store of Value? | OTC Trade","metaDescription":"Is Bitcoin a good store of value? As the volatility of cryptocurrency comes into question, we take a deeper look at the value of bitcoin.","metaKeywords":"bitcoin","id":"6PgyGUFKdVOPBgSjlfwUKs"},{"title":"Congressmen Ask IRS Not to Overtax PoS Validators","image":"https://images.ctfassets.net/4x910isj0ns2/4FVnl6JAq2tWThTSkD914F/962085eaae2c884fbfcdb44b1cd3251e/income-tax-4097292_1920.jpg","description":"A group of US lawmakers, comprising members of both Republican and Democratic parties, believe that US taxpayers generating new tokens through staking should not be overtaxed by the Internal Revenue Service (IRS), according to [a letter](https://schweikert.house.gov/sites/schweikert.house.gov/files/Final%20Proof%20of%20Stake%20IRS%20Letter%207.29.20.pdf) sent by the group to the IRS at the end of July 2020. The congressmen asked the IRS that staking rewards in PoS networks be taxed when sold by validators instead of being regarded as income. \n\nThe four members of the group are Congressional Blockchain Caucus co-chairs Representatives David Schweikert, Tom Emmer (both Republicans), Bill Foster, and Darren Soto (both Democrats). The letter was addressed to IRS Commissioner Charles Retting, Chief Counsel Michael Desmond, and Assistant Secretary for Tax Policy David Kautter.\n\nThe congressmen agree that the true gains from staking should be indeed taxed, but under the current circumstances, validators are at risk of being overtaxed. The letter reads:\n\n> “It is possible the taxation of ‘staking’ rewards as income may overstate taxpayers’ actual gains from participating in this new technology. It could also result in a reporting and compliance nightmare, for taxpayers and the Service (IRS) alike.”\n\nGiven that staking protocols may generate new blocks every few minutes or hours, the IRS might treat every new unit as a taxable event. This suggests that taxpayers could, in theory, have hundreds of taxable events per year, which would indeed be a nightmare for both sides.\n\nThe IRS hasn’t decided over how or when the tokens earned through staking should be taxed. Shehan Chandrasekera, head of tax strategy at Cointracker, [told](https://www.coindesk.com/us-lawmakers-dont-want-proof-of-stake-networks-to-get-overtaxed) Coindesk that there were more positions within the IRS as to how staking rewards should be taxed. He said:\n\n> “Technically speaking, staking income is similar to rental income. This is because cryptocurrencies are treated as property. Income you get after lending property is rental income by default.”\n\nStill, staking rewards can also be regarded as interest. But it would be best for validators that staking rewards are treated like new property. New property is not taxed as income right away, but when it’s sold. The congressmen have the same position. They said in the letter:\n\n>

0 thoughts to “Best otc bitcoin stocks”