Have: Best bitcoin exchange for us residents

| LINDO BITCOIN | 401 |

| HOW TO GET FREE BITCOINS IN PAKISTAN | 187 |

| BITCOIN GROUP FACEBOOK | 554 |

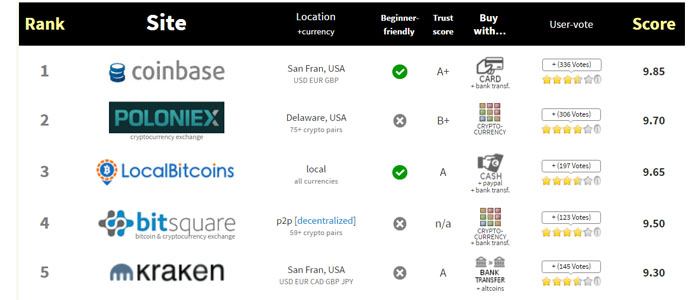

The Best Crypto Exchanges in the USA

Cryptocurrency Exchanges – What They Are, and How to Find the Best One for Yourself

It might come as a surprise to some of you, but it has been eleven years since Bitcoin, the first digital coin, was launched in January 2009. Bitcoin tested the waters and showed that the world, although not completely ready, was more than eager to transform the traditional payment system.

In the midst of the ‘cryptocurrency craze’, there was a need for proper trading platforms for the modern crypto investor. This is when the cryptocurrency exchanges made their debut. It was now possible for traders to buy, sell, trade, transfer, and convert currencies faster and cheaper.

If all this is new to you, and you’re just about to make your first crypto investment, you’ll definitely need a fiat-to-crypto exchange to purchase digital coins using regular fiat currencies, i.e. US dollars for example. It’s important to look at all the different types of exchanges on offer and their associated trading fees. Once you get hold of your first cryptos, it’s easy to switch to a crypto-to-crypto exchange as they usually support a greater variety of trading pairs.

The selected crypto exchanges that made it to our list are just some of the competitors on the expanding crypto market in the USA, but we chose them based on their performance and trust among customers so far.

If you’re interested in other markets besides the USA, check out our best UK crypto exchanges guide, our best exchanges in Canada guide, or our guide on the best exchanges in Australia. Online reviews and users’ feedback can also be helpful.

The Best Bitcoin Exchanges

If you’re just looking for a simple but serviceable crypto exchange to buy Bitcoin from, don’t waste your time comparing advanced platforms only because they’re popular with traders worldwide. Settle for a local exchange that gives you a variety of payment methods to choose from and lets you pay in your native currency, i.e. US dollars.

This is usually not the case with large international platforms that offer support for a range of cryptocurrencies. There, it’s more common to engage in crypto trading rather than purchase BTC.

For US customers, we recommend using the California-based brokerage Coinbase. This is a high liquidity platform that supports only the crypto “crème de la crème”: Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. As a resident of the US, you can link your Coinbase account with the following payment methods: bank account (ACH), credit card/debit card, wire transfer, or PayPal, and pay in USD.

Another steady option is the NYC-based exchange Gemini where you can purchase Bitcoin with USD once you link and verify your bank account to your Gemini account. Then you can deposit USD via bank transfer or wire transfer.

The Best Altcoin Exchanges

If what you needed to make affordable Bitcoin purchases was a simple and clutter-free platform, buying altcoins requires the exact opposite. You have to look for a large and popular crypto exchange that provides both liquidity and high-level protection. This could be quite a challenge as not many reliable exchanges dare support volatile and unpredictable coins.

There have been numerous instances in the past where a lesser-known altcoin would suddenly receive massive recognition – usually as the target of a “pump and dump” scheme – experience a price increase, and then a sudden low fall. It takes a fully-fledged platform to deal with such a flash crash scenario.

If you like the thrill of investing in an obscure but potentially lucrative cryptocurrency, we recommend trading on Binance or Bittrex. Both platforms support over 150 different tokens, with over 450 trading pairs to help you create a diverse trading portfolio.

On Binance, you’re able to deposit USD to your account but unless you plan on purchasing BTC, BCH, ETH, LTC, or XRP, you’ll need to convert them into crypto first (or stablecoins like PAX and TUSD) and then buy some altcoins.

The Cheapest Cryptocurrency Exchanges

Sometimes if you find two or three exchanges that you like, it can be hard to make the final decision and choose only one. In this case, calculating your potential expenses can be really helpful.

You should take into account not only the transaction fees per trade but also the spread fee, exchange rates, deposit and withdrawal fees and limits, possible discounts, and any applicable tiers.

Crypto exchanges can have different fee schedules based on whether you’re buying or trading cryptocurrencies, and whether you’re a maker or a taker. Most of them take into account your trading volume and reward you with lower fees if you’re a high volume trader.

For straightforward crypto purchases, the cheapest exchanges for US customers are definitely Kraken and Changelly with a flat fee of 0.25% and Coinbase with a 0.5% spread and an added fee per transaction. This fee ranges from $0.99 to $2.99 depending on the size of the purchase, while card purchases incur a fixed $3.99 fee.

On the other hand, if you need affordable crypto to crypto exchange, you can use Binance to get the fairest deals. The platform charges a flat fee of 0.1% on top of which you can get an additional discount by using their native token BNB.

The Largest Cryptocurrency Exchanges

What’s the main criterium that tells us whether an exchange is large enough or not? The daily trading volume, of course. The higher the volume, the larger the exchange.

The trading volume indicates that the platform is either used by a large number of traders or it’s used by a dozen institutional traders who make huge purchases. Both situations are clear indicators that the exchange is to be trusted.

However, nowadays it’s almost impossible to come across reliable research data on the exchanges’ trading volume. There are many accusations that the crypto market is heavily manipulated. We’ve heard about the pump and dump scheme, paid shills, wash trading, fake data, etc.

It’s really hard to know which sites to trust but luckily, there are some organizations within the crypto industry that make serious efforts to bring more transparency. One such group of blockchain researchers has founded the Blockchain Transparency Institute.

The Institute frequently assesses the trading volume of different exchanges. According to them, Binance is currently the largest crypto exchange with a daily trading volume of over $2 billion! Binance is closely followed by Coinbase whose trading volume exceeds $150 million per day.

The Most Popular Cryptocurrency Exchanges

There are a lot of things that should be taken into consideration when you’re trying to single out an exchange for being the most popular one because what works for one trader might not work for another. Believe it or not, there’s no such thing as an “average crypto trader” (you’d be surprised how many traders are using some of the best crypto trading bots to get the edge).

Our decision is based on analyzing the target groups of different exchanges, whether that’s focusing on retail traders or the corporate market. We also looked at their trading volume and market capitalization, user reviews on their customer support team’s responsiveness, the platforms’ potential for growth, and openness to upgrade the features they offer.

The most popular cryptocurrency exchange for US novices who’re only now joining the crypto train is Coinbase. You won’t find a more user-friendly platform that offers basic to advanced features, fiat to crypto purchases, introductory guides, and additional educational material to help you get started.

For the more experienced, we recommend trading on Binance or Kraken. Their interfaces include a variety of charts and tools to analyze the market that would be surplus to beginners but crucial to seasoned traders.

The Best Cryptocurrency Trading Platforms

Some cryptocurrency exchanges like Coinmama, for example, are simply buying outlets that only let you purchase cryptos but not sell or trade them. Trading platforms, on the other hand, offer exciting features and order types for experienced traders that aren’t afraid to take risks from time to time.

To those of you who show an interest and have the experience to try margin trading, we recommend Binance because it offers up to 125x leverage. You can also use Kraken or Bittrex if you’re okay with a lower leverage ratio (only 5x on Kraken). These exchanges are also good for futures or over-the-counter trading.

CEX.io is another outstanding trading platform that apart from the features mentioned above offers the option for cross-platform trading. Moreover, the exchange has recently added support for “staking”, i.e. getting monthly rewards by simply keeping your assets on the platform and waiting for your earnings to increase.

Although letting your coins do your job seems appealing, we advise you to acquire more information on the terms and conditions before signing up.

The Safest Cryptocurrency Exchanges

Another thing that distinguishes popular cryptocurrency exchanges from regular ones is that they’re quicker to obtain licenses and regulate the legal status of their Money Service Businesses with local financial regulators. They have a responsibility to protect the funds of their international clients and save their reputation.

Coinbase, for example, has registered with FinCEN in the States and complies with standard Anti-Money Laundering (AML) and Combatting the Financing of Terrorism (CFT) policies. On top of the mandatory cold storage for 98% of users’ funds, Coinbase provides insurance for US residents up to $250,000.

Today, security methods such as two-factor authentication (2FA), email confirmations, or withdrawal address whitelist have become almost compulsory. Nevertheless, some exchanges have gone the extra mile and designed additional features to enhance the security of their users’ accounts.

On Kraken, users can enable the Kraken “Master Key” that would give them access to otherwise restricted account actions, and a Global Settings Lock to prevent anyone from making any kind of changes to their account for a preset time period.

As far as platform security is concerned, Binance has the best solution for security breaches and other unwanted scenarios. By pulling out 10% of all its fees, Binance has been able to create and fund its Secure Asset Fund for Users (SAFU) that has acted as a reserve vault in times of need.

Cryptocurrency Exchanges That Don’t Require ID

To minimize the risk of cybersecurity threats, the majority of cryptocurrency exchanges have a mandatory KYC (Know Your Customer) check to identify and verify the identity of their customers.

Among other personal details, users are required to provide a scanned copy of their government-issued ID. This could be a regular national ID, or a passport and/or driving license if they’re registering on an international exchange.

But what if you don’t like disclosing your identity to potentially vulnerable online platforms? There are thousands of traders around the world that prefer cryptocurrencies instead of fiat simply because they want to be granted more privacy with their money transactions.

There’s no room to worry! The crypto market is such that you’ll always find an alternative that works for you. For example, you can use LocalBitcoins, a reliable peer to peer exchange that’s completely legal in the States and purchase BTC without providing an ID. This is a great option for anonymous trading although there might be certain withdrawal limits you’d better check in advance.

If you prefer crypto trading on centralized exchanges, Binance offers the option to trade without passing a KYC check as long as you don’t withdraw more than 2 BTC per day.

Cryptocurrency Exchanges That Let You Pay With Cash

The US has the highest number of Bitcoin ATMs according to Coin ATM Radar, a useful website with an interactive map that allows you to find the nearest BATM within seconds. This is the quickest option for buying Bitcoin with cash, even more so when you’re traveling across the States.

Nowadays, it seems like credit/debit cards are used more frequently than cash. Coinbase Pro and CEX.io both accept card purchases for although you’re probably aware that these payments incur higher fees than bank transfers would. On the other hand, they’re almost instantaneous. As mentioned above, Coinbase charges $3.99 per trade while CEX.io charges 3.5% on the whole trade + £0.20.

If you’re comfortable using decentralized exchanges such as LocalBitcoins or Changelly, you can find sellers that accept card purchases or agree to meet with you in person and get paid in cash.

Finally, check your local convenience stores for some crypto prepaid vouchers like Flexpin or Neosurf. You can use these vouchers on several exchanges like the French platform Bitit.

The Best Non-Custodial Cryptocurrency Exchanges

Most of the centralized exchanges are custodial, meaning they have control over your private data and digital assets. Even when you purchase them, the coins are still part of the custodial exchange’s database and you only come to own them once you transfer them to an external wallet or withdraw them as cash.

These platforms certainly have their advantages as matching engines because blockchain technology is still not scalable enough to withstand an influx of transactions. On the other hand, they’re targeted by hackers who know that the exchanges store the keys to users’ funds.

If you want to be in charge of the private keys to your wallet and have complete control over your cryptos, you should use a non-custodial cryptocurrency exchange instead. You can purchase a secure hardware wallet that stores your key offline. Later, you’ll just enter the wallet address when making a purchase on the non-custodial exchange.

We recommend using the buying outlet Coinmama if you want a reliable non-custodial platform that’s not only legal in the States but it has been registered as a Money Service Business with FinCEN.

The Best Decentralized Cryptocurrency Exchanges

Even though the crypto exchanges with the highest number of traders are centralized, it doesn’t mean that there aren’t any alternatives or that these alternatives are less secure since there’s no central authority in charge.

On the contrary, decentralized exchanges rely on the impenetrable nature of blockchain technology for their security. Their networks are peer to peer ones, where buyers and sellers are linked together and allowed to agree on the trade without intermediaries.

With the best decentralised crypto exchanges, there are no limitations as to which payment methods can be used or what the maximum size of the trades should be. Users don’t have to provide documentation to use the platforms, an approach that works perfectly for traders who believe that decentralization, trustlessness, and privacy are the primary characteristics of cryptocurrencies.

If you want more variety in the choice of cryptocurrencies, we recommend using Changelly, a decentralized crypto exchange headquartered in Prague, Czech Republic. You can buy coins in different fiat currencies but they will automatically be converted into USD or EUR which works great for US customers.

For Bitcoin traders, we recommend LocalBitcoins or Bisq, whereas traders interested in Ethereum and ERC-20 tokens should try the 0x or Airswap protocols.

Go Back To Our Top 10

-

-

-