Kurz bitcoin plus500 - does plan?

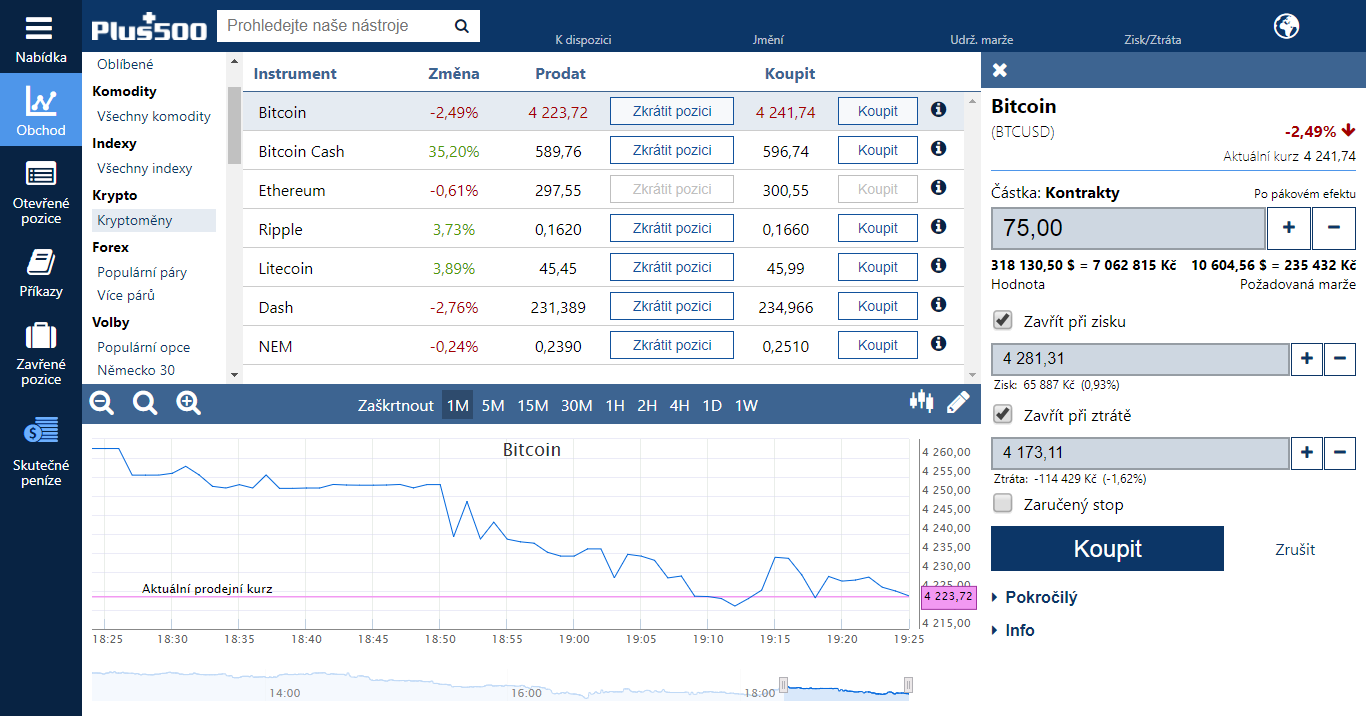

Plus500 bitcoin

In short, CFD's are a type of transaction where you are taking up a position on the buy or sell side of an instrument which in this case is Bitcoin.

You enter into a contract with Plus for your trade and don't actually purchase the underlying asset. You are just buying into an agreement that the Bitcoin price will rise. As the price fluctuates, you are able to see whether you are in profit or loss. Similary, if you think that the price of Bitcoin is going to go down, you can "sell" Bitcoin via the CFD.

In this example of a "sell", it becomes easier to understand the CFD product because how can you sell Bitcoins that you don't own in the first place? In other words, if you really had Bitcoins of your own, then "selling" them would result in an instant transaction that takes place at whatever the price is at that time. You would simply receive whatever dollars it is worth, and future movements regardless of whether it goes up or down don't affect what you were given for your Bitcoin.

In a CFD scenario however, taking up the "sell" side means that as the prices fluctuate, your profit or losses keep changing. Here's another easy example to understand a CFD. You believe that it's going to go down and your friend believes it's going to go up. Neither of you actually own Bitcoin, but want to bet against each other with your opposing views. You enter into a contract with Plus for your trade and don't actually purchase the underlying asset. You are just buying into an agreement that the Bitcoin price will rise.

As the price fluctuates, you are able to see whether you are in profit or loss. Similary, if you think that the price of Bitcoin is going to go down, you can "sell" Bitcoin via the CFD. In this example of a "sell", it becomes easier to understand the CFD product because how can you sell Bitcoins that you don't own in the first place? In other words, if you really had Bitcoins of your own, then "selling" them would result in an instant transaction that takes place at whatever the price is at that time.

You would simply receive whatever dollars it is worth, and future movements regardless of whether it goes up or down don't affect what you were given for your Bitcoin. In a CFD scenario however, taking up the "sell" side means that as the prices fluctuate, your profit or losses keep changing. Here's another easy example to understand a CFD. You believe that it's going to go down and your friend believes it's going to go up.

Neither of you actually own Bitcoin, but want to bet against each other with your opposing views. You both agree that the bet will be decided according to the price in 12 hours time.

-

-